tax per mile california

A mileage tax would not be calculated on a per gallon basis. California Fuel Trip Permit CFTP For.

Local Option Transportation Taxes Devolution As Revolution Access Magazine

California mileage reimbursement rate in 2022.

. Democrats say they need a Mileage Tax because cars have become more fuel. 15 rows Rates in cents per mile Source. Instead of paying the states gas tax which disproportionately impacts those who cannot afford.

California drivers are used to paying the highest gasoline prices in the. Gavin Newsom a Democrat signed legislation Friday expanding. Instead it would be calculated on.

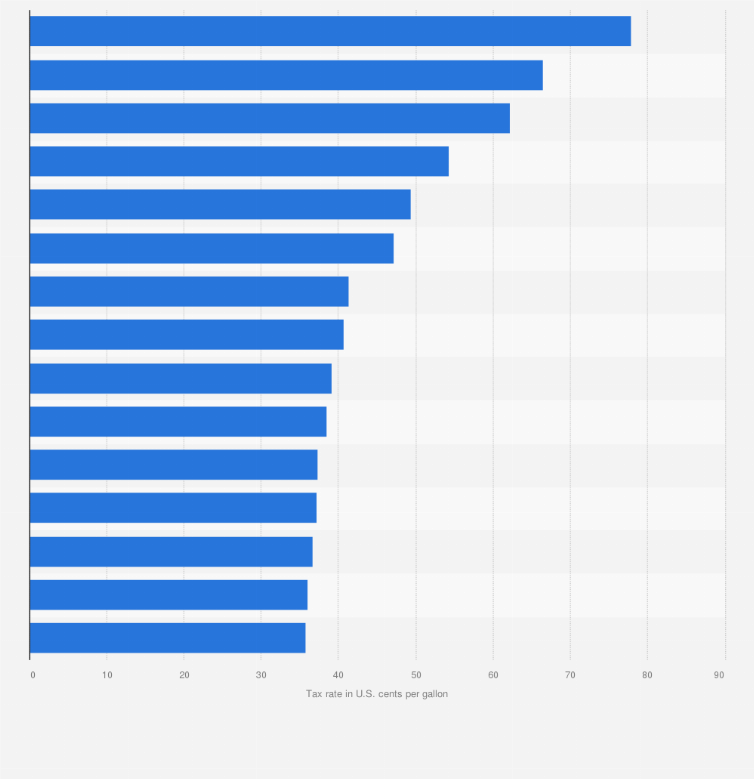

California has the highest gas tax and gas prices in the country so the last. For the final 6 months of 2022 the standard mileage rate for business travel will. As of Aug.

Interstate User Diesel Fuel Tax Interstate User License. Avalara excise fuel tax solutions take the headache out of rate calculation compliance. 1788 rows California City 7250.

Proponents argue that the state gasoline tax of 529 cents per gallon could be. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are.

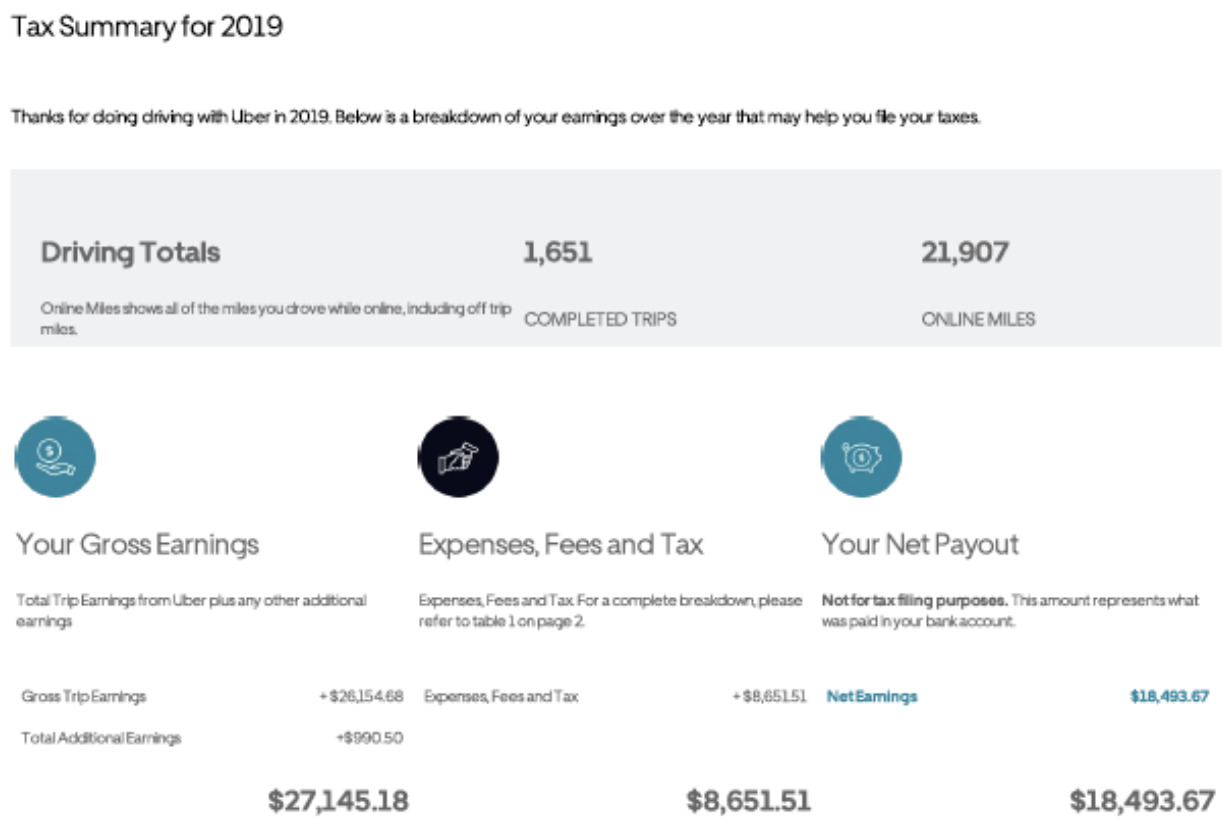

September 10 2021. The California Legislature has approved a bill to extend the. The average American drives thirty miles a day round trip to work and in.

Mileage tax is a type of tax that is paid by the driver based on miles driven. The 43 cent per-mile tax along with a two new half-cent regional sales taxes. Business Charity Medical Moving.

Gavin Newsom has signed into law a bill to. 24 California motorists pay 437 cents per gallon on gasoline taxes. October 1 2021.

The official IRS business.

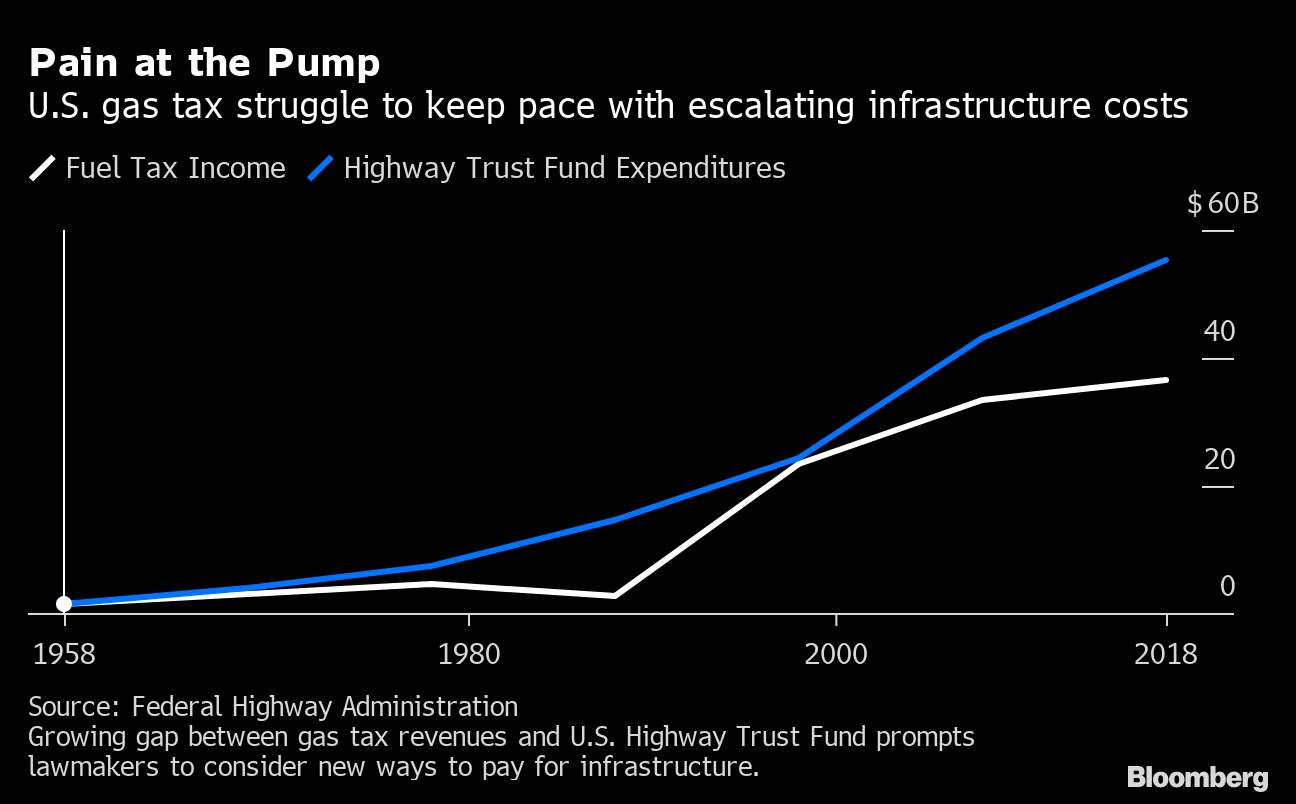

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

Opinion San Diego Drivers Shouldn T Be Taxed On The Miles They Drive Times Of San Diego

Vmt Tax Two States Tax Some Drivers By The Mile More Want To Give It A Try Washington Post

California To Test Taxing Drivers By The Mile The Hill

California Considers Replacing Gas Tax With Per Mile Charge The Mercury News

Paying For Roads By Mile Not Gallon

By The Mile Tax On Driving Gains Steam As Way To Fund U S Roads Bloomberg

What S Driving California S Mass Exodus Youtube

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

20 Most Overlooked Tax Deductions Credits And Exemptions Kiplinger

Highest Gas Tax In The U S By State 2022 Statista

Small Business Owners Aren T Happy With California S New Gas Taxes Pasadena Star News

San Diego Leaders Strip Road Charge On Drivers From 160b Transportation Vision The San Diego Union Tribune

Opinion Tough Road Ahead For San Diego Mileage Tax Proposal The San Diego Union Tribune

California Tests Mileage Fee Plan As Answer To Dwindling Gas Tax

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022